The Stagflation Monster

If you were a particularly nervous child, you might have been frightened by the idea that monsters could be hiding under your bed while you slept at night. Today, economists have a similar fear, but this one has a name. It’s called ‘stagflation.’

Stagflation is a pretty simple concept: it stands for an economic condition where the economy is in recession, but also features high inflation. In a stagflation economy, people put off buying for two reasons: they are less able to afford it, and prices are higher than they are accustomed to paying.

Economists fear stagflation because it presents policymakers—the people who are supposed to guide our economy out of difficult circumstances—with an insoluble dilemma. If they raise interest rates to fight inflation, they will inevitably push the economy deeper into recession. If they lower rates, they trigger higher inflation. Heads you lose, tails you lose.

The last time America experienced stagflation was the 1970s, and it wasn’t pretty. The markets were down, unemployment was high and home mortgages ran into the double digits, making housing unaffordable. Companies were laying off workers, ultimately pushing the unemployment rate above 10%.

Unfortunately, stagflation is in the news again. Why? One of the impacts of high tariffs is higher prices for consumers. There have been reports saying this is nonsense, but common sense suggests otherwise. If foreign manufacturers have to pay 20%, 30%, 70%, 150% of the price of their goods at the border, their most likely response is to raise prices, perhaps not as high as the tariff, but higher prices will show up in the inflation rate. Domestic manufacturers, meanwhile, have to import raw materials from abroad, and many of them are relying on fabrication plants in East Asia and Mexico for component parts. All of these companies would pay a toll as their component items cross the border, and this, too, is reflected in prices. More inflation.

The solution—which would be impossible to implement immediately—is to hire American workers to do the fabrication work and somehow find a way to source raw materials domestically. But American workers are considerably more expensive than the workers who are doing the work now. Higher costs mean higher prices.

But what about the economic impact? High tariffs act as sludge in the machinery of international trade. Reciprocal tariffs abroad, targeting American goods and services, would reduce markets and sales. Less sales means lower economic activity—and profits. It could also mean layoffs, which would reduce consumer purchasing power, adding to the problem.

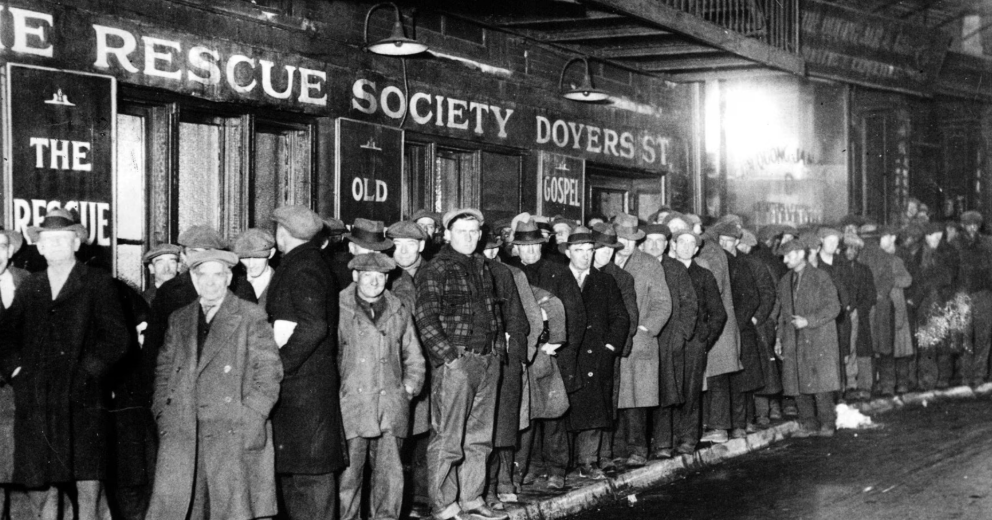

Of course, we don’t know the outcome of the tariff negotiations that are due to resume in earnest on July 9. But it’s worth remembering that the last time America imposed high duties on foreign goods was the Smoot-Hawley Tariff Act of 1930. Historians have a name for the economic period that followed that infamous piece of legislation. They call it The Great Depression.